Business Insurance in and around Columbus

Calling all small business owners of Columbus!

No funny business here

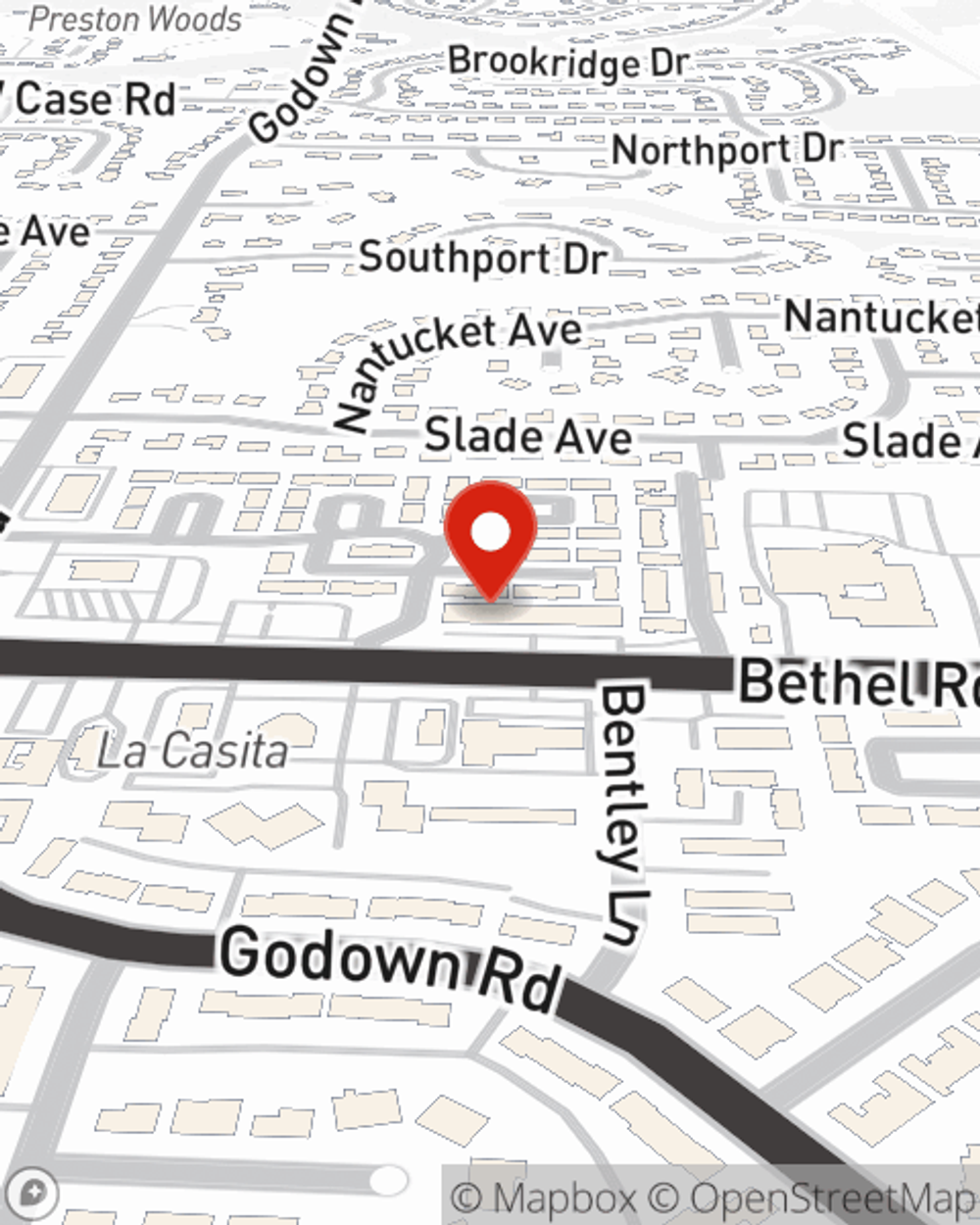

- Columbus, Ohio

- Dublin, Ohio

- Hilliard, Ohio

- Worthington, Ohio

- Westerville, Ohio

- Grove City, Ohio

- Upper Arlington, OH

- Gahanna, Ohio

- Powell, Ohio

- Marysville, Ohio

- Plain City, Ohio

- Delaware, Ohio

- New Albany, Ohio

- Whitehall, Ohio

- Pickerington, Ohio

- Reynoldsburg, Ohio

- Canal Winchester, OH

- Sunbury, Ohio

- Springfield, Ohio

- Cincinnati, Ohio

- Dayton, Ohio

- Cleveland, Ohio

- Akron, Ohio

- Toledo, Ohio

Business Insurance At A Great Price!

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Adam Deel. Adam Deel relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Calling all small business owners of Columbus!

No funny business here

Protect Your Business With State Farm

If you're looking for a business policy that can help cover business property, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Visit State Farm agent Adam Deel's team today with any questions you may have.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Adam Deel

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.